The latest Norway oil find is another drop in Barents barrel

The next big thing in Norwegian offshore oil has just gotten more feasible.

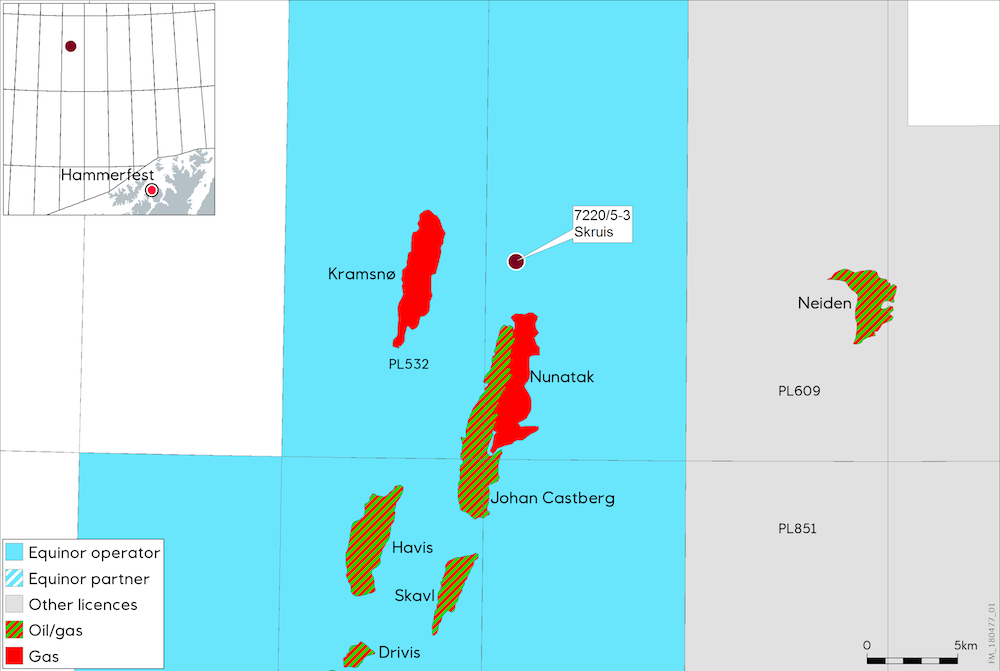

Measured by its size, the discovery announced earlier this week by Equinor, Norway’s state-controlled oil firm, is marginal. The Skruis find, in the northern Barents Sea, contains at most 25 million barrels. This is probably just 4 percent of the monstrous Johan Castberg Field. But what Skruis lacks in size, it makes up for in location.

Though not a part of the Johan Castberg Field, Skruis is within its license area. That, first and foremost, gives Equinor, and its partners Eni, an Italian firm, and Petoro, another firm controlled by the Norwegian state, permission to exploit what they found there.

More important, though, is that, because of its proximity to the Johan Castberg Field, Equinor would able to use the infrastructure it is putting in place there, should it drill Skruis.

Approved by the Storting (Norway’s national assembly) in June, the Johan Castberg Field is scheduled to come online in 2022. In 2012 Equinor (then called Statoil) estimated it would cost 100 billion Norwegian kroner ($12 billion) to develop the Johan Castberg Field. After taking steps to reduce its costs, the company now believes it can do it for half that.

Calculated per barrel, this means that projected production costs have shrunk from $80 to about $30 — or about half of the current going rate.

The Skruis find comes after Equinor announced last year that it had made another minor discovery, this one about 50 million barrels. Added to the list of wells Equinor already has on its docket, the addition of last year’s find means Equinor will be operating at full capacity in the Johan Castberg license area until at least 2026. Skruis, if it is pursued, would extend the period further.

In addition to increasing the size of reserves in the Johan Castberg license area, these smaller adjacent finds are important, Equinor reckons, because they confirm that the Barents Sea has the potential to pick up the slack as production in the North Sea winds down.

“Securing resources near existing infrastructure is an important part of Equinor’s ambition and strategy on the Norwegian continental shelf,” Nick Ashton, an Equinor executive, said in connection with today’s announcement.

[For Norway’s next big oilfield, size isn’t everything]

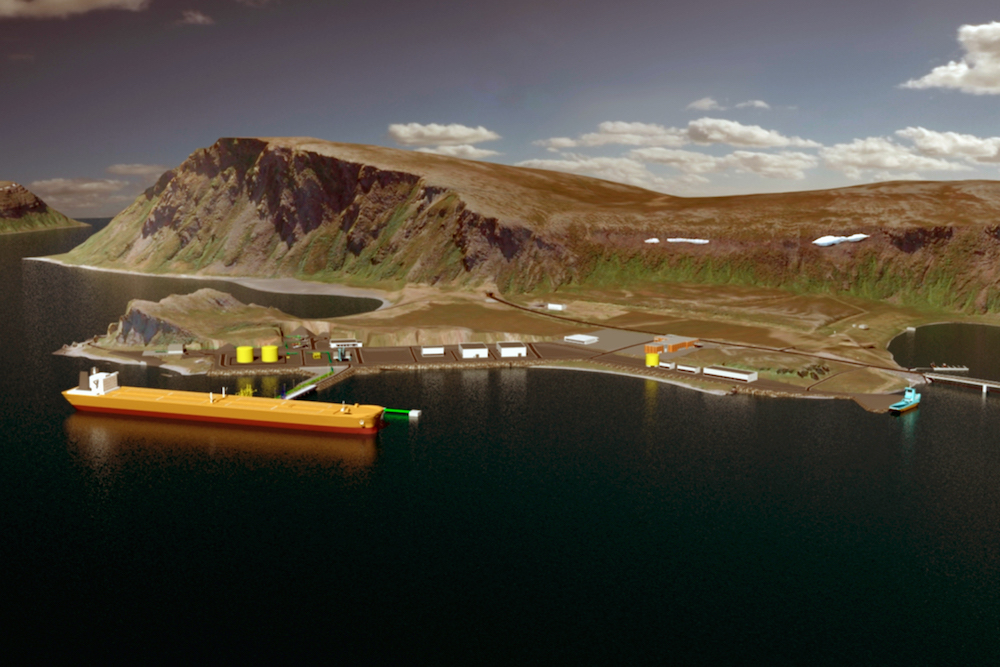

One of the main reasons why Equinor was able to reduce its price was its decision to use a vessel to produce, store and off-load oil from the field, rather than build something on-shore.

Lower costs mean greater returns for Oslo, but lawmakers would prefer to have something on shore, since it would mean more jobs. Equinor has not ruled out a terminal entirely, and a final decision about whether to build one is expected sometime in 2019.

Still, its warning that there are “significant differences in costs” between bringing the oil to shore in a pipeline before transferring it to ships and doing it at sea, seems to indicate the way it is leaning. This, though, is its position based on the original finds. With the discovery of two new fields nearby, Norway may be able to have its Castberg and a terminal, too.