Winter transits along the Northern Sea Route open up a new frontier in Arctic shipping

Last week three ice-capable LNG carriers traveled the length of the route without icebreaker escort for the first time during the middle of winter.

There are few places in the world where the impact of climate change is more tangible than the Arctic. The melting of sea ice is quickly transforming the Arctic Ocean into a navigable sea. Groundbreaking winter transits, deemed technically and economically impossible as recently as a decade ago, now hold promise for year-round shipping along Russia’s Northern Sea Route.

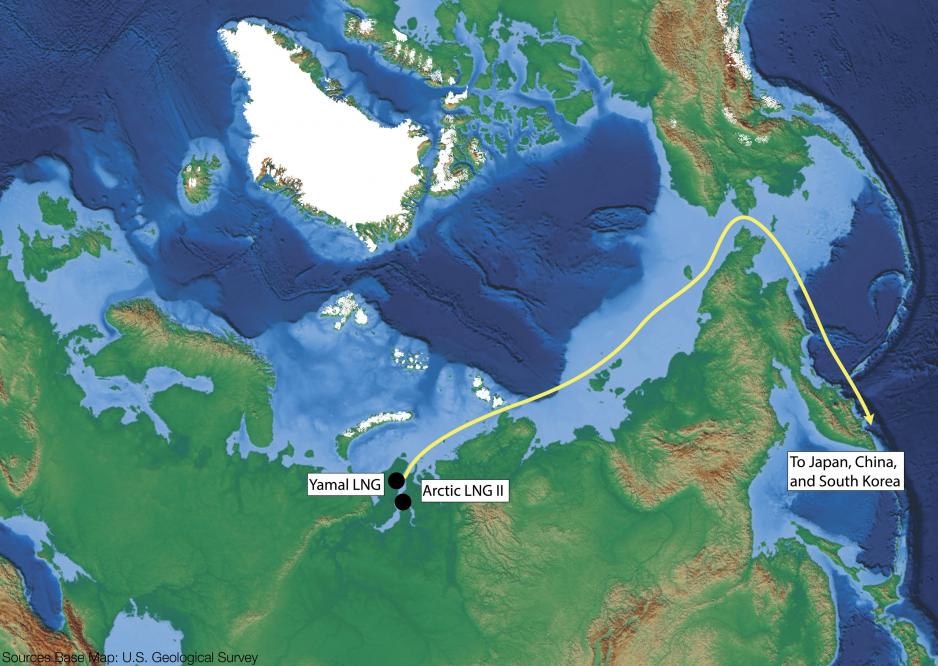

For the past three years Russian natural gas company Novatek has shipped LNG from its plant on the Yamal peninsula to Asia during the summer and fall. Last week three of its icebreaking Arc7 LNG carriers transited the Northern Sea Route without icebreaker escorts, delivering natural gas to Asia during winter for the first time. The test voyages confirm the technical feasibility of Novatek’s goal of delivering LNG to Asia year-round.

Two vessels, Christophe de Margerie and Nikolay Yevgenov, traveled from the port of Sabetta laden with LNG and are en route to South Korea and China, while a third, Nikolay Zubov, was traveling in the opposite direction returning to Sabetta in ballast after delivering LNG to China.

“These independent tanker voyages made in January are the result of the targeted work of the company and its partners to expand the navigational season for LNG shipments from our Arctic projects,” noted Leonid Mikhelson, Novatek’s Chairman of the Management Board.

According to Novatek the voyages took place in average ice conditions more than two months after the end of the traditional navigation season in the Eastern part of the Arctic, which usually ends in November.

The ability to ship LNG to Asia is an essential part of the company’s long-term business plan of extracting natural gas in the Arctic, liquefying it into LNG, and using ice-capable tankers to deliver it to wherever it can achieve the highest price, primarily Asia. In fact, spot prices in the region are so high at the moment that Novatek plans to send several LNG tankers to Japan next month, albeit with the assistance of nuclear icebreakers.

Finding a path through the ice

Even with Arctic sea ice melting at record levels, traveling along the NSR during winter is no easy feat.

According to industry experts, the winter transits of Christophe de Margerie, Nikolay Yevgenov, and Nikolay Zubov would have been planned for weeks if not months.

“Considerable effort goes into planning and execution. We can assume that the same rigor taken for other voyages was ramped up even more, ensuring the best possible ice information was available on an ongoing basis,” explains David Snider, Owner of Martech Polar Consulting, a provider of Polar and ice navigation services. “It doesn’t pay to have such a high value cargo trapped.”

As such the “go/no-go” decision would not have been taken lightly considering that everyone is watching these voyages very carefully.

“No one onboard or ashore wants negative publicity. They have very likely made EVERY effort to ensure risks are low,” confirms Snider.

Even with ideal conditions the crews of the three vessels are still faced with 24 hours of darkness and Arctic weather conditions.

“It is more stressful for the crew and the ship due to the polar night and very low temperatures. The ship and its equipment are designed to work in these harsh winter conditions, the Arc7 carriers are certified to -52°C,” explains Hervé Baudu, Chief Professor of Maritime Education at the French Maritime Academy.

Of course most of the work happens on the interior of the ship in comfortable working conditions. There may be ice pilots – specially trained mariners – on board, but it is not required by Russian authorities. However, under the Polar Code established by the International Maritime Organization in 2017, all deck officers must receive mandatory ice navigation training, including advanced level for the commanding officer and senior staff.

The ships are also equipped with specialized ice radars and powerful searchlights to assist in navigating through the ice.

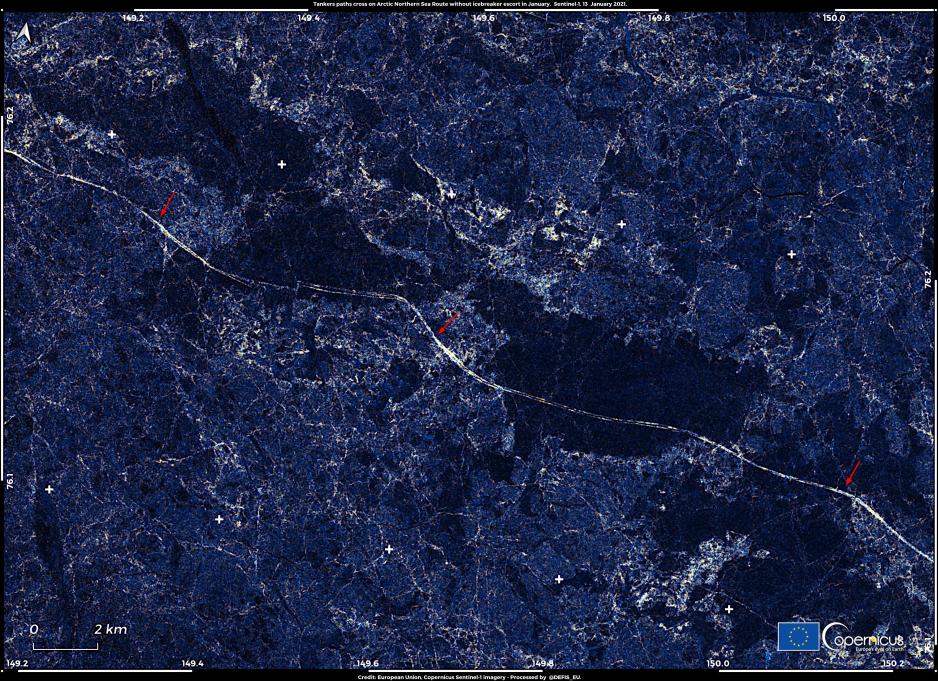

In contrast to voyages in open water where routes are planned in advance, navigating through Arctic sea ice happens in real time. “The hardest part is the prediction of the transit route according to the ice. One thing is very important to understand when navigating in ice. Unlike meteorology where you can make reliable forecasts to optimize a transit, you cannot predict the ice evolution for the following week,” explains Hervé.

The receipt of new satellite images can take several hours or even days.

Ice navigation is a rapidly developing discipline which makes use of computer models and artificial intelligence. In October, Russia opened a new headquarters for sea operations in Murmansk tasked with the development of shipping lanes in the eastern part of the NSR.

“We have put into operation the headquarters for maritime operations, which allows using AI technologies to work out the tracks of ship movements and partially provide services without icebreakers. The synergy of information technologies and the capacity of new icebreakers will allow the development of the eastern route,” said Mustafa Kashka, General Director of Atomflot.

Novatek relied on these outside resources to find a path through the ice.

“All three of the Arc7 ice-class LNG tankers independently passed the ice-covered part of the NSR, without ice-breaker support, along the navigational routes recommended by the State Research Center ‘Arctic and Antarctic Research Institute’ and Atomflot’s Marine Operations Headquarters,” explains the company in a statement.

Climate change and technology alter economic realities

Novatek’s Yamal LNG project, the first of its kind in the Arctic, came online in December 2017. The company relies on a fleet of fifteen icebreaking Arc7 LNG carriers – owned and operated by its shipping partners Sovcomflot, Dynagas, Teekay, and MOL – to transport product from the Yamal peninsula to the marketplaces in Europe and Asia.

The first-generation Arc7 ice-class LNG carriers were designed to transport LNG to Asia via the NSR only during the summer months. During winter, when Arctic sea ice remained too challenging, the company’s plan was to ship its LNG to Europe where sea ice is much less of an issue.

However, this economic and technical equation is now rapidly changing. With this month’s test voyages Novatek is inching closer to its goal of shipping LNG to Asia year-round.

“After years of gaining experience, the operators now feel confident that they can safely push the seasonal envelope of Arctic shipping,” explains Snider of Martech. It is, however, important to understand what they are trying to accomplish and what they are not.

“They are not attempting to run across the top of the Arctic ocean, they are operating in regions that are predominantly only first year ice,” Snider elaborates.

Each experimental voyage allows mariners to increase their confidence in the ship’s design and operational capability, and enhances the level of experience of the crew. They also build credibility with Russian authorities which have to sign off on all traffic on the Northern Sea Route.

The current winter transit is also not the first test voyage. In 2020, Sovcomflot’s Christophe de Margerie, the lead Arc7 LNG carrier, conducted a trial voyage to Asia in May – a full two months earlier than previous voyages. In that case, however, the ship traveled with nuclear icebreaker escorts.

And while the ice-going capability of the first-generation Arc7 LNG carriers is already well-known through multiple full-scale ice trials as well as hundreds of voyages in less-challenging ice conditions, these types of experimental voyages also help validate economic models. This latest test voyage will be useful to verify the results of more complex transit analyses. With this Novatek will attempt to model ship- and fleet-level performance on new routes during different seasons, industry experts confirm.

The ultimate goal of these tests is to gain operational experience and collect data for future year-round LNG shipments.

And this future may now only be 2-3 years away. Novatek’s next project, Arctic LNG 2, is currently under construction just 100 kilometers from Yamal LNG on the other shore of the Gulf of Ob. Novatek says the plant will begin production at the end of 2022 or early 2023. In contrast to Yamal LNG, which ships the majority of its natural gas to Europe, Arctic LNG 2 focuses on Asian markets requiring year-round eastbound shipments.

Building even more ice-capable LNG tankers

Novatek is again cooperating with Aker Arctic – a Finnish engineering company specializing in the design of icebreakers – to improve upon Aker’s plans for the original Arc7 LNG carrier. The second generation Arc7 LNG carriers will be fitted with slightly more powerful engines and feature an optimized hull design for enhanced ice-breaking and fuel efficiency gains. So far the company, in cooperation with its shipping partners, has placed orders for 21 Arc7 carriers of the second generation. By 2030 the company aims to rely on a fleet of up to 50 vessels to ship its LNG.

The first-generation Arc7 carriers have proven highly capable in transiting the NSR even during late fall and spring, exceeding original design specifications. The Arc7 vessels are based on Aker’s double acting ship design.

“The ships operate bow first in normal sea and lower ice conditions in a more fuel efficient and sea kindly manner. In heavier ice they are intended to operate stern first, in essence, the stern is designed as a more efficient ice breaking “bow” that is not as efficient in open water,” elaborates Snider. Over the past couple of years this type of design has proven itself as very efficient.

In fact, during initial ice trials Christophe de Margerie, the lead vessel of the Arc7 class, even outperformed one of Russia’s nuclear icebreaker’s Yamal in a heavily-ridged ice field. According to industry experts, the vessels are the most capable icebreaking cargo ships afloat today.

Novatek hopes that the second-generation carriers will be even more suitable for Arctic operations and, above all, more fuel efficient, especially during independent operation without icebreaker escort.

“The characteristics of the second-generation Arc7 tankers are a little bit different from its predecessor,” confirms Baudu from ENSM. “The power of the engines has been increased, probably to gain speed in reverse. The shape of the hull forward has also been optimised with a hollower bow to better pass through the ice compression crests when sailing forward.”

The optimised hull shape will allow the LNG carriers to sail a larger portion of their voyages in forward orientation, improving fuel efficiency compared to traveling stern-first.

And while independent navigation will become increasingly feasible during most of the year it may at times be more economical for the Arc7 carriers to travel with icebreaker escorts. For this purpose the width of the ships has also been reduced from 50 meters to 48 meters to more easily travel in the icebreaker’s wake. While such changes may appear minor, they will have a significant impact on fuel consumption.

“The escorted ship’s progress is slowed down by the pressure of ice along the hull. The Arc7 carriers, which are wider than the icebreaker, must be fast enough to move through the channel and fight the pressure but also the friction of the ice along the hull. This increases fuel consumption,” details Baudu.

“Whether in forward or reverse, the more ice you have to break, the higher the consumption will be. The cost of consumption must not be higher than normal navigation through the West. This transit test will validate this model,” says Baudu.

How many icebreakers will Novatek need?

There is also another, more practical, reason for these experimental voyages. Novatek’s partners in the Russian state apparatus – especially Rosatomflot, the operator of the country’s nuclear icebreakers – aim to determine how many new nuclear icebreakers the country needs to build over the coming 10-15 years to ensure the uninterrupted flow of natural resources to Asia.

“The main reason for the test voyages is to confirm that the 50 Arc7 tankers scheduled to sail in 2030 all year round on the NSR can navigate without the help of an icebreaker escort,” says Baudu. “Novatek needs to ‘calibrate’ the route and determine the degree of autonomy of the LNG carriers when sailing alone.”

Build too many or too powerful icebreakers and Rosatomflot could soon sit on a fleet of nuclear icebreakers no longer needed as ice melt accelerates. Build too few and Novatek’s grand plans to ship LNG year-round could suffer.

Novatek and its shipping partners have a financial incentive to use the Arc7 to their full capabilities saving costly fees for icebreaker escorts. “No one wants the expense of paying for icebreaker escort,” explains Lawson Brigham, a researcher at the University of Alaska Fairbanks and a Fellow at the U.S. Coast Guard Academy’s Center for Arctic Study & Policy.

In addition to five new Arktika-class nuclear icebreakers Atomflot has also drawn up plans to build an even larger nuclear icebreaker. The “Leader”-class icebreaker was specifically designed to break a 50 meter-wide channel to escort Arc7 carriers and other cargo vessels through the ice even during the heart of winter between February and May, when ice is thickest. Construction on the inaugural Leader-class icebreaker has started but questions remain if it will be needed and if so, if additional vessels of the type have to be constructed.

“Atomflot needs to know if it is necessary to build two more Leader-class icebreakers by 2035,” the company’s deputy director Vyacheslav Ruksha stated last month.

Expanding Arctic shipping beyond LNG

Arctic shipping activity on the NSR is not limited to Novatek’s operations, but the company’s efforts are by far the most advanced. Russian oil producer Gazprom also uses ice-capable tankers to ship crude oil from the Arctic to Europe, but has yet to send its cargo to Asia. Chinese shipping company Cosco transports bulk items across the route during summer.

The growing activity is a testament to the importance of developing shipping along the route for Russia.

“The Arctic is the shortcut between the largest markets of Europe and the Asia-Pacific region,” Russian President Vladimir Putin said almost ten years ago in 2011. “It is an excellent opportunity to optimize costs.”

As such, developing shipping along the route is a policy priority for the Russian government. Over the past decade it has spent billions of dollars on icebreakers, search and rescue installations, and infrastructure to create a safe and competitive transport environment in the Russia Arctic – all with the ultimate goal of eventually ensuring year-round navigation along the NSR.

Despite Novatek’s accomplishments, however, it remains unlikely that other forms of traffic, namely container shipping, will set sail for the Arctic anytime soon.

In 2018, Danish operator Maersk conducted a unique test voyage sending the first-ever container ship along the route during summer. The Venta Maersk transited the route from East to West delivering containerized cargo to Bremerhaven and Saint Petersburg. After the test voyage the company decided it would remain a one-off and it would not return to the route in the near future.

Shipping experts also express doubt that the specifics of container shipping – regular liner service and just-in-time deliveries – make this type of traffic suitable for the NSR.

“Using ice-capable vessels for containers could be done from a technical point of view, but the cost is high; and it is still not sure they could guarantee just-in-time delivery. Low freight rates preclude the profitability of such a route,” explains Arctic shipping expert and Professor at the Université Laval Québec, Frédéric Lasserre.

This point is echoed by Brigham. “I do not believe this is the beginning of regular, bulk carrier or container ship traffic on this winter route. Shippers would need to have Polar Class 3 or 4 ships of similar capability to the LNG icebreaking carriers. So I don’t think this operational achievement has much relevance beyond the linkage of LNG to global markets.”

Nonetheless, several companies, including Atomflot, aim to ship containerized cargo via the NSR in the future – likely subsidized by the Russian government.

While the designing, constructing, and placing into service of the Arc7 carriers is impressive from a technical standpoint, the increase in shipping traffic worries environmental advocates. So far, the NSR has escaped serious mishaps and accidents, but there exists a growing list of safety violations – including an incident involving an Arc7 carrier in 2018.

Safety and environmental concerns have prompted a number of major shipping companies to issue pledges to not ship via the Arctic.

For now the development of Russia’s Northern Sea Route continues at a rapid pace and with this week’s winter transits Novatek took a major step in turning it into a year-round trade route connecting Europe to Asia via the Arctic.