The Week Ahead: Closing the gap

When indigenous fashion designers gather in Toronto this week, the goal will be as much to tell as it is to show.

With its daily runway sessions, trade-show exhibitions and four-day program, Indigenous Fashion Week Toronto has a lot in common with any of the industry’s other fashion weeks.

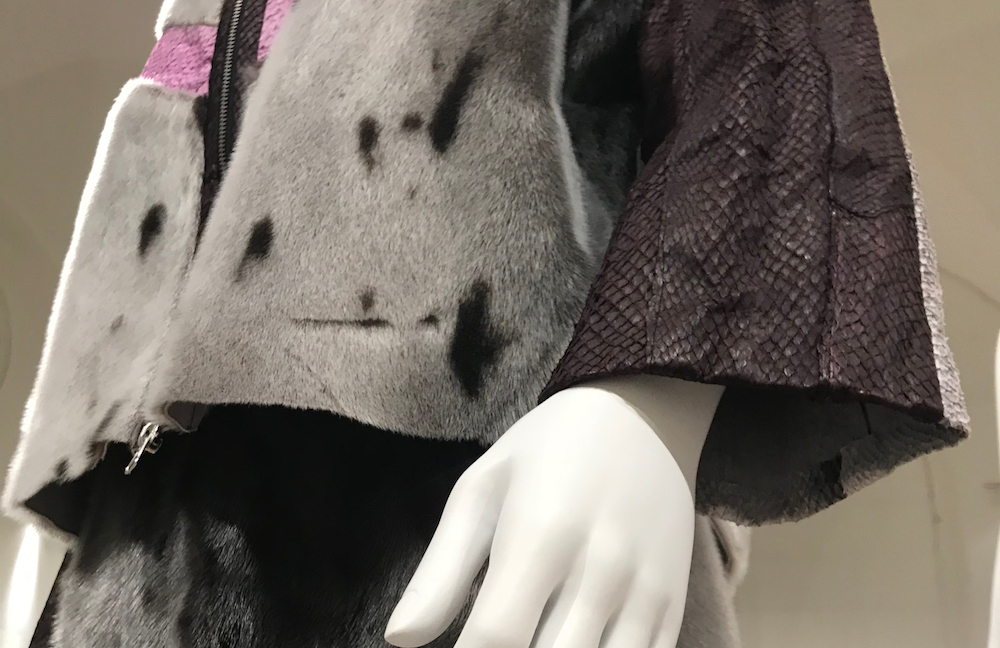

In all, some 23 indigenous designers from Canada, the U.S. and Greenland will show their fashions. Traditional regalia will be shown, but the focus will be on clothes that — if not mainstream — can be worn by all: Styles range from streetwear and avant garde to jewelry and craft.

Putting local designers center stage is a common way for the second-tier cities of the fashion world (everyone but London, Milan, New York and Paris) to stand out in a crowded field. Toronto, too, hopes this strategy can help those showing this week get their break.

“IFWTO is about carving out space for Indigenous fashion, craft and textiles,” Sage Paul, the event’s artistic director, said in a statement.

Still, Toronto will have plenty that distinguishes it from other fashion weeks. Paris has probably never had Navajo rug-weaving, let alone talks about how fashion can upend colonial mythologies.

Few other than practitioners will be interested the hands-on sessions, but the other non-runway events that aim to explain what Indigenous fashion is — and is not — seek to engage a wider audience.

One of the points of these events is to repeat the Indigenous perspective about materials like sealskin and fur: That they are natural, local and necessary for Northerners. And that, compared with industrially produced materials, like leather, they are more sustainable. They will also argue that eliminating opportunities for commercial sale renders subsistence hunting provisions worthless.

Another big topic will be cultural appropriation. Once an accepted practice, today it is increasingly seen as a no-no that displays cultural ignorance. Put in terms creatives can understand, Indigenous groups argue this is the equivalent of intellectual-property theft.

Some cases are blatant — for example, the parka produced by a British design firm in 2015 that was an exact copy of a sacred Inuit garment — others less so. But, when offending designers are called out, they generally defend such use as inspiration, or as a form of homage.

Making references are commonplace in mainstream fashion and design. Is there a closer connection between fashion and culture when it comes to indigenous art? One talk will discuss just when it is that inspiration becomes insult, but a rule of thumb appears to be that the clothes make the culture.

“Indigenous fashion can redefine mainstream fashion and art: our fashion illustrates our stories, traditions, sovereignty and resiliency,” Paul said.

What went up may now be going back down again

On May 23, Marketplace Morning Report, a podcast, aired an episode titled ‘How high can crude oil go?’ With oil prices nearing $80 a barrel — double what it was when it fell to its lowest price in the slump that began in 2014 — the question now becomes, at what point do price rises become counterproductive for producers and destructive for the economy.

What is driving the turnaround? Uncertainty over whether Iran will be permitted to sell its oil is one factor in the increase. The rally, however, began in 2017, when OPEC, a producers’ cartel, and Russia, agreed to prop up prices by keeping production down. That has helped draw down global stocks of oil by about half.

How high will oil go? Likely not much higher than $80. OPEC and Russia appear to be ready to end their self-imposed limits. Opening the spigots and adding more oil to the market will drive crude prices down. That will address concern that further price rises could spark a recession, as well as appease Donald Trump, who has complained that OPEC’s cut has driven oil prices to an artificially high level.

Arctic production is still waiting for its day, but the price machination is still something of a sour note. Rystad Energy, a consultancy, calculates that average production prices for the region is around $80 per barrel.

The Week Ahead is a preview of some of the events related to the region that will be in the news in the coming week. If you have a topic you think ought to be profiled in a coming week, please email [email protected].