Iceland’s booming tourism market draws big players in Alaska real estate

JL Properties, one of the biggest players in Anchorage real estate, is among an early wave of foreign firms drawn to Iceland’s roaring tourism sector, with the company in the midst of securing an ownership stake in one of the country’s largest hotel chains.

JL’s foray into Keahotel, a group of eight hotels, made national news in the country of 330,000. Frettabladid, Iceland’s largest newspaper, ran a story with a headline translated as: “The richest man in Alaska is buying one of the country’s largest hotel chains.”

And Iceland Magazine, an English-language publication, ran a story in June under a similar headline: “Alaskan real estate tycoon buying one of Iceland’s largest hotel chains.”

Jonathan Rubini, the chairman, chief executive and “J” of JL Properties, called the stories premature, saying the deal has yet to be concluded. In emails with Alaska Dispatch News, Rubini said his company was in the process of taking an initial 25 percent stake worth about $6.5 million in Keahotel in what’s estimated to be a $51 million deal involving multiple partners including Alaska investment firm Pt Capital and a group of Icelandic investors.

“The proposed transaction is being negotiated, but final agreements have not been signed,” Rubini wrote.

The Keahotel chain employs 250 people at its properties in the capital city of Reykjavik and northern Iceland. Its rooms are not priced for budget travel. A search for rates for four days in Reykjavik in mid-August yielded a low of $230 per night at the chain’s urban modern Skuggi Hotel and a high of $490 per night at the historic Hotel Borg.

Investment in Iceland’s lodging sector appears promising, with the country hosting ever-greater numbers of visitors each year. Tourism spending has been a major factor in Iceland’s emergence from the devastation of the global financial crisis. Since 2010, the sector has grown by an annual average of 20 percent.

“The tourism industry is growing so fast, we can barely cope with it,” said Thordur Hilmarsson, the director of the Reykjavik-based organization Invest in Iceland.

Hilmarsson said there’s a growing interest by foreign investors in tourism. Last year, nine boutique hotels projects drew foreign investment, although, he said, “not all will be realized.”

Led by Rubini and Leonard Hyde, JL boasts a portfolio of real estate and other investments worth at least $2 billion. The company owns and manages more than a quarter of Anchorage’s Class A commercial office space, including the headquarters of both ConocoPhillips and GCI.

Outside Alaska, JL built hotels at Walt Disney World in Orlando, Florida, and owns a gated recreational vehicle park three hours south in Fort Myers. It also has real estate investments in Utah and Georgia, according to its website.

Despite sitting at the top of Alaska real estate and, with his partner Hyde, being named one of Alaska’s richest men by Forbes magazine, Rubini considered the billing of “tycoon” in the Icelandic press to be an insult.

“That ‘tycoon’ label is beyond stupid and inaccurate,” he wrote. “I certainly don’t think of myself as a ‘tycoon’ or ‘mogul.’ Not even if you add ‘mini’ as a prefix.”

Rubini said diversifying away from Alaska’s economy “was part of the thinking” in moving forward with the investment.

The state’s current recession has taken a bite out of JL’s segment of the real estate market. Construction on office space, malls and other buildings is way down. Leasing demand for commercial office space has also eased off.

Iceland, a volcanic Nordic nation known for its hot springs and otherworldly landscapes, is a popular destination for Alaskans. The direct flight on IcelandAir from Anchorage to Reykjavik is just seven hours, not much longer than a flight to Houston.

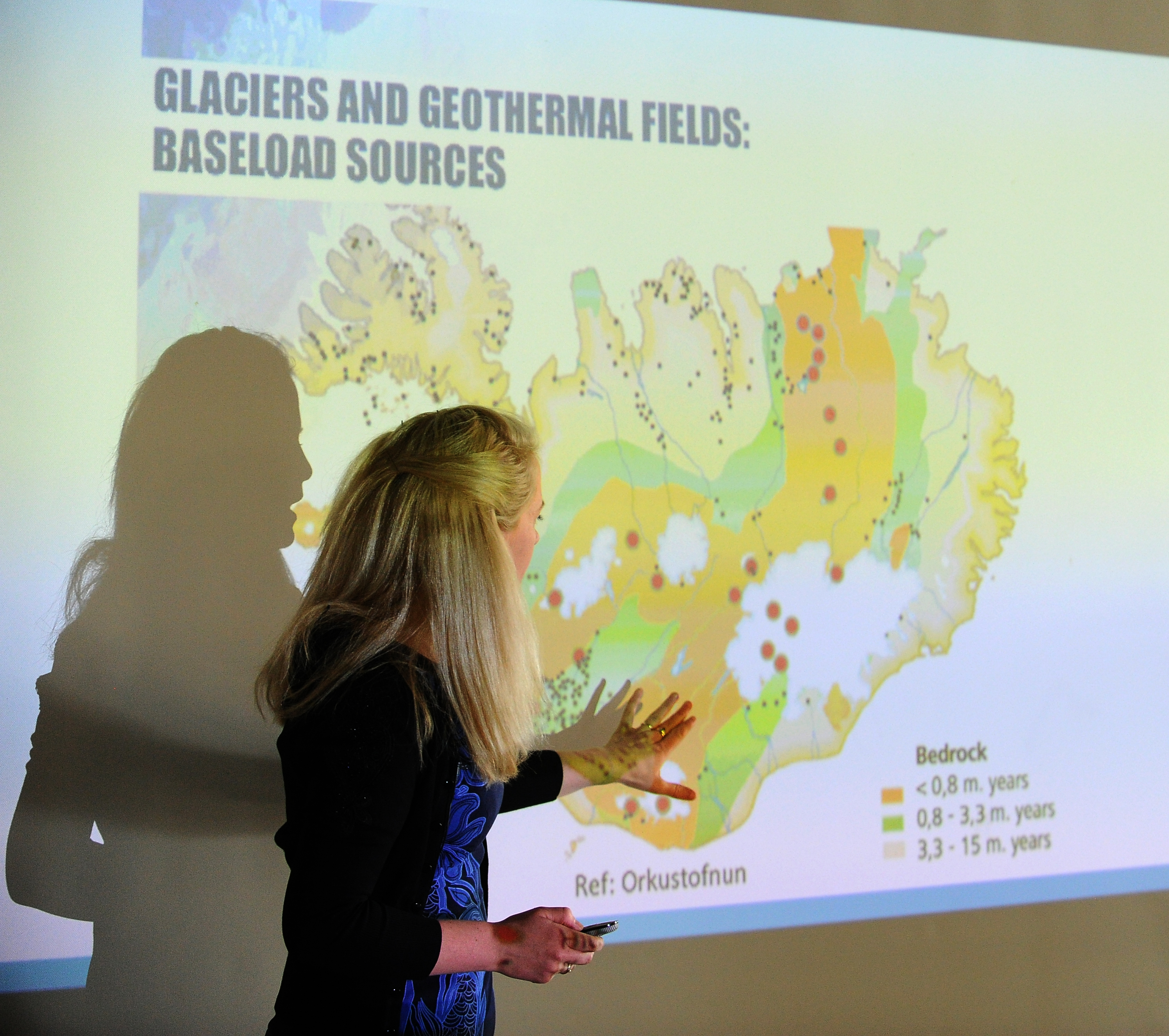

At a presentation in Fairbanks in May, Halla Hrund Logadottir, a government energy adviser from Iceland, asked who had visited her country. She appeared surprised when about a third of the several dozen people in the audience raised their hands.

JL isn’t the only Alaska firm to invest in Iceland. Earlier this year, Anchorage private equity firm Pt Capital announced it was in the process of purchasing all shares of Nova, an Icelandic telecommunications company that covers 34 percent of the country’s mobile services market. (According to state corporation records, Alaska Dispatch News and Arctic Now owner Alice Rogoff owned 5 percent of Pt Holding Co. LLC at the time of its initial report in 2013, though her share declined to less than 5 percent subsequently. The holding company owns Pt Capital.)